Wave: Small Business Software Wave Financial

Can manage multiple businesses for free under one account; lacks project tracking tools, industry-specific reports and transaction tracking tags. These 14 states include tax services with the option to automatically transfer tax payments and file the paperwork with your state tax office and the IRS (this excludes 1099 Filings). We provide different levels of support, depending on the plan and/or the add-on features you choose.

Easily switch from another payroll provider

Transactions will appear in your books automatically, and you can say goodbye to manual receipt entry. Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption. Our (non-judgmental) team of bookkeeping, accounting, and payroll experts is standing by to coach you—or do the work for you.

Accountant-friendly software

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it https://www.personal-accounting.org/what-are-outstanding-shares/ enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Tools that help you make money moves

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy. https://www.personal-accounting.org/ To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

- Strong invoicing feature competes with that of paid products; app lets users send invoices on the go; offers significantly fewer reports than competitors; no inventory tracking.

- Have an eye on the big picture so you can make better business decisions.

- A critical component of your business plan is the market research section.

- Having a business plan can help make those benchmarks more intentional and consequential.

Amazing App and service

Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing. A business plan is a page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows. All your invoicing and payment information automatically syncs with our free accounting software included with your account. Every invoice paid means more revenue coming into your small business. Create and send professional invoices to your customers in seconds.

Accounting software that works as hard as you do

In August, 2012, the company announced the acquisition of Vuru.co,[10] an online stock-tracking service. Zoho Books offers a robust free plan, along with a range of paid plans that feature workflow automation. QuickBooks Online’s detailed reporting and transaction tracking is ideal for growing businesses. FreshBooks is an affordable option for freelancers types of assets and small service-based businesses that operate mostly on the go. Allows an unlimited number of users in the Pro plan, but is not complex enough for businesses with more than a handful of employees; ideal for very small service-based businesses, freelancers or contractors. Many or all of the products featured here are from our partners who compensate us.

She was also an analyst in buy-side investment management and worked in investment banking.Michaella received her MS in Finance, summa cum laude, from University of Denver. She also earned her BSBA in Finance from the University of Denver where she graduated in three years and was honored as a Coca-Cola Scholar and a Boettcher Scholar. Michaella sits on several nonprofit boards including SLC6A1 Connect, an organization that advances scientific research to ultimately result in a cure for the rare disease. She is a national champion equestrian (her lifelong passion) and loves hiking, biking, and being in the great outdoors.

See our step-by-step guide on how to import bookkeeping data into Wave here. When everything is neatly where it belongs, tax time is simple. Wave’s smart dashboard organizes your income, expenses, payments, and invoices.

Similar to other reputable cloud-based accounting software products, Wave encrypts the data you share with it and monitors its server facilities 24/7. We believe everyone should be able to make financial decisions with confidence. This app is super helpful, the main issue I have while using it is the lag. When inputting information the character count for it is super slow/delayed to where it forces me to stay on a certain page until it registers that information has been inputted. After inputting information and trying to click done at the bottom it will not register unless I swipe the keyboard away. Clicking done in the top right corner works half the time, with it also glitching and forcing me to start over everything by taking me back to whatever page I was on prior to creating a new contact or new invoice.

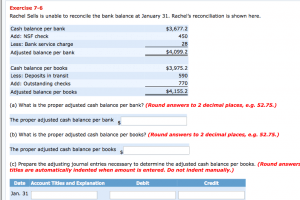

It’s also missing an audit trail and third-party integrations. When you reconcile your books, you’ll navigate to the “Reconciliation” tab within the Accounting menu. If you need to manually edit, add or remove any transactions, you can do so on the Reconciliation or Transactions pages. Next, you can add sales tax (if necessary), create customer profiles and customize your invoice templates.

I look at the dashboard and know how many invoices are on the way, when they should be paid, and the average time it takes someone to pay. Compared with free software like Wave, QuickBooks plans are expensive. The most basic plan, Simple Start, costs $30 per month, and the top-tier Advanced plan costs $200 per month, which is a sizable investment if you’re running a business on a tight budget. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the app marketplace.

Wave’s software is free, as opposed to freemium, in that the tools can be used without tiers or limits indefinitely. Wave previously included advertising on its pages as a source of revenue. Support for non-paying users is limited to the chatbot and self-service Help Center. Only pay for what you use and simplify annual audits with workers’ comp built for small business owners. Ready to invoice in style, bookkeep less, and get paid fast? “It’s not just a cool piece of software, it is giving peace of mind to people.” You deserve to know your taxes aren’t something you have to sweat over the entire calendar year.”

With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer. If you’re on-the-go, you can also send invoices from your phone or other mobile device using the Wave app. With Wave’s Pro Plan, you can set up recurring invoices and automatic credit card payments for your repeat customers. Switch between automatic and manual billing whenever you want.

Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business owners in the US and Canada take control of their finances.